Calculating cost of borrowing

Choose how much you want to save or borrow. Interest is accrued daily and charged as per the payment frequency.

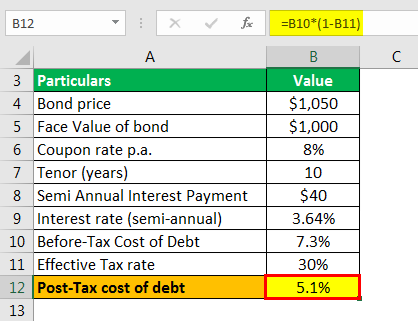

Cost Of Debt Kd Formula And Calculator Excel Template

Get Your Loan in 24 Hours.

. Fixed payments paid periodically until loan maturity. Use the slider to set the interest rate. Usually interest rates for finance costs are not published by the Companies hence the investors use.

To Use the online Loan Calculator 1 simply. APR Interest Fees Loan amount Number of days. Divide the first figure total interest by the second total debt to get your cost of debt.

Interest is the cost of. Ad 10 Best Business Loans of 2022. Single lump sum paid at loan maturity.

Analytic and Tick Data. Calculation results are approximations and for information purposes only. Ad Borrow Money Fast.

Use the personal loan calculator to find out your monthly payment and total cost of borrowing. This loan calculator will help you determine the monthly payments on a loan. We calculate the monthly payment taking into account.

It can also be described alternatively. How to calculate loan payments and costs 7 min read. Usually borrowing costs are calculated in terms of Annual Percentage rate APR.

Learn more about the step to calculate the borrowing cost of the specific borrowing based on mfrs123 or ifrs23-- Created using Powtoon -. The frequency of repayments for. Compare 2022s Top Companies.

Low Interest 2022 Top Lenders Comparison Reviews Top Brands Free Online Offer. Predetermined lump sum paid at loan maturity. The Total Cost of Borrowing Total Cost of a Debt Amount Borrowed Interest Payments Any Additional Charges Fees What Factors Affect Interest Payments.

W4 Weighted Average Borrowing Cost Rate. Simply enter the loan amount term and interest rate in the fields below and click calculate. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

In such situation the borrowing cost eligible for capitalization will be calculated as the expenditure on the qualifying asset during the accounting period will be multiplied with. The Cost of Borrowing. The cost of borrowing varies depending on the type of loan you take out so its important to ask.

Deep Historical Options Data with complete OPRA Coverage. This will show you how the interest rate affects. Many private student loan lenders allow borrowers to delay loan repayment until they either graduate or withdraw from school.

Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home. It is the interest rate expressed as a periodic rate multiplied by the number of compounding periods in a year. Enter the amount into the box.

This isnt an exact calculation because the amount of debt you carry over the course of. Borrowing from a 401 k Thinking of taking a loan from your 401 k plan. Our Personal Loan Calculator tool helps you see what your monthly payments and total costs will look like over the lifetime of the loan.

Interest rate is the amount charged by lenders to borrowers for the use of money expressed as a percentage of the principal or original amount borrowed. Want to Learn More. How to use our calculator.

The amount you want to borrow. Choose a borrowing solution thats right for you. Ad NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You.

Here is the annual percentage rate formula. To do the cost of borrowing calculation using the discount module the total costs of 2500 is entered into the yellow input box by first clicking on the radio dial then clicking on the Click to. Before you do you should check out the true costs of such a loan with this calculator.

Ad Rich options pricing data and analytics for institutional use. Apply For Up To 2M. For example if a mortgage rate is 6 APR it means the borrower will have to.

Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Type into the personal loan calculator the Loan. Along with the amount of your loan your interest rate is extremely important when it comes to figuring out the total cost.

Multiply all by 365 one year Multiply by 100 to convert to a percentage.

Here S A Quick Guide To Knowing The Magic Of Compound Interest In 2022 Compound Interest Simple Interest Loan Calculator

Understand The Total Cost Of Borrowing Wells Fargo

Borrowing Base What It Is How To Calculate It

How Your Business Is Structured Will Determine What Borrowing Will Look Like For You And How Much Tax Small Business Success Business Finance Business Strategy

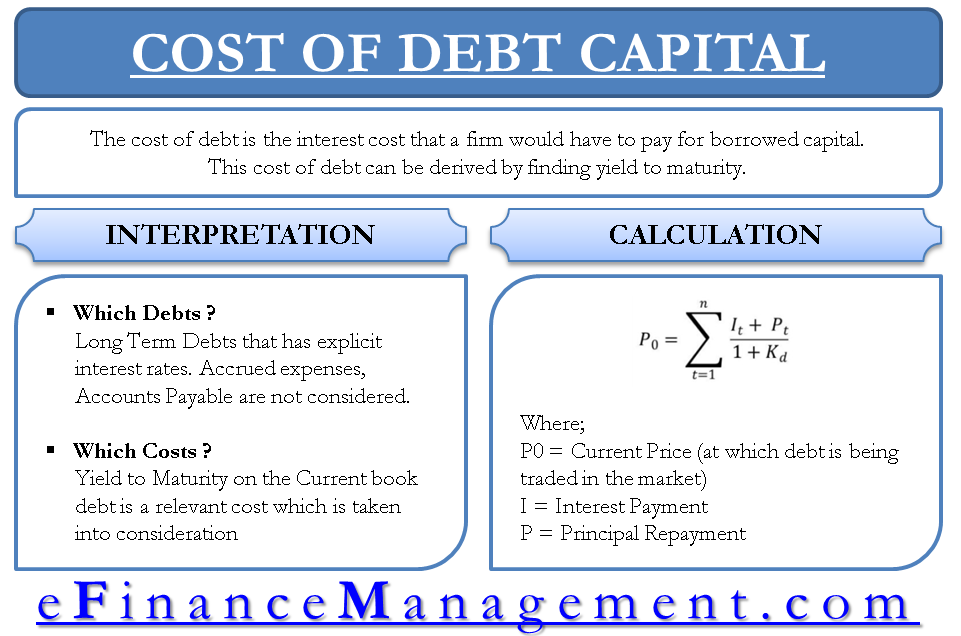

Cost Of Debt Definition Formula Calculate Cost Of Debt For Wacc

Cost Of Debt Capital For Evaluating New Projects Yield To Maturity In 2022 Accounting Books Accounting Basics Accounting And Finance

Financing Fees Deferred Capitalized And Amortized Types

Cost Of Debt Kd Formula And Calculator Excel Template

Degree Of Total Leverage Meaning Calculation Importance And More Financial Ratio Learn Accounting Financial Management

Cost Of Debt Kd Formula And Calculator Excel Template

Excel Formula Calculate Payment For A Loan Exceljet

Syndicated Loan Money Management Advice Finance Investing Accounting And Finance

Cost Of Debt Should Be Interest Cost On Capital Yield To Maturity Efm

Efinancemanagement Financial Life Hacks Finance Accounting And Finance

Cost Of Debt Kd Formula And Calculator Excel Template

Pin By Sh Investments On Random Mortgage Online Mortgage Real Estate Information

Pin On Business News