How much can i borrow for a personal loan calculator

As you register you get a rate quote within 15 seconds. That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term.

Personal Loan Vs Line Of Credit How To Choose Credible

As part of an affordability assessment lenders will check your credit.

. With a Shared Equity mortgage youll receive an equity loan which well treat as part of your deposit. For federal student loans your limit depends on whether you can. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

How much can you borrow. A car loan calculator and a personal loan calculator are very similar apart from one key feature. This will allow you to check the rates that are available to you.

Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments Bankrate. Heres how a personal loan calculator can help you in different situations. You can also input your spouses income if you intend to obtain a joint application for the mortgage.

Compare home loans on Canstars database. As a car loan is typically secured against the vehicle and secured loans generally come with lower interest rates. Theyll check W-2s bank statements and employment records.

Compare home buying options today. 2000 cashback when you refinance to us If youre eligible and you apply to move your home loan to us by 28 February 2023 you could get less home load with 2000 cashback. If youre looking to get a new loan only borrow if its needed planned and youve budgeted to pay it back.

How much can I borrow. The default interest rate. Factor in income taxes and more to better understand your ideal loan amount.

The calculator also helps you determine the effects of different interest rates and levels of personal income on how much mortgage you can afford. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. We dont currently offer Shared Equity schemes online so please either give us a call or visit us in branch.

Use this home loan calculator as a guide to find out how much you may be able to borrow based on your current income and expenses. But ultimately its down to the individual lender to decide. How much would a loan cost me.

Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any. Borrow as much as you need. Check out our borrowing power calculator to estimate how much you can afford to borrow as well as repayments on a personal loan.

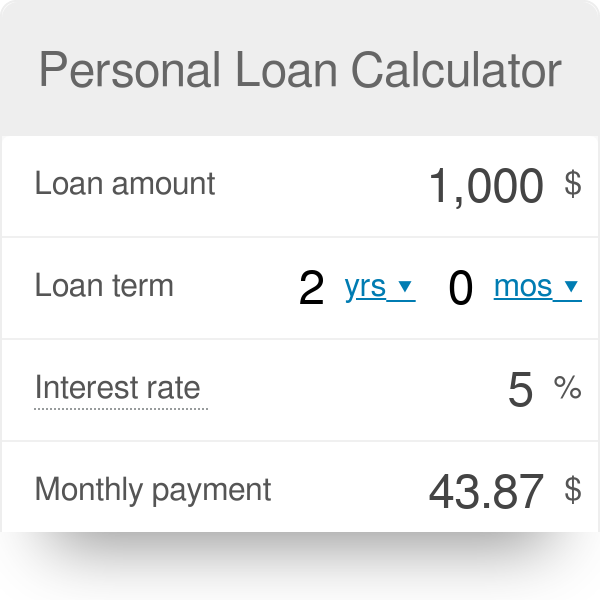

A personal loan calculator helps you understand how much you can borrow and what your repayments will look like over time. Our maximum mortgage calculator helps you calculate the maximum monthly mortgage payment and total mortgage amount you can afford. The loan is available for as low as Rs.

Gifts or loans from relatives and programs like an 801010 combination loan can help you avoid PMI. 5 Lakhs for up to 3 years ie. Some of the striking features are.

A Residential Owner Occupied rate or Residential Investor rate will. Theyll check W-2s bank. Even then borrow as little as possible and repay as quickly as you can.

So if for example youre trying to decide between a loan with a longer repayment term and a lower interest rate say 10 years and 5 and a loan with a shorter repayment term and a higher interest rate like 7 years and 8 the loan calculator can help you decide which to go withwhether you want the lower total payoff amount or the. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. StashFin online personal loan app offers instant credit line up to Rs.

Your expenses can be impacted by things like the number of dependents in your family any current home or personal loan repayments and other financial commitments such as private health insurance. You can use the above calculator to estimate how much you can borrow based on your salary. How much can I borrow.

If you NEED a loan our calculator will tell you how much your monthly repayments would be plus the total amount of interest you. The longer term will provide a more affordable monthly. If youve already started looking for properties you can enter a property value and deposit amount into the calculator and well show you your Loan to Value LTV ratio.

See the example below. How long will I live in this home. If you have no deposit and need to borrow the full amount otherwise known as needing a 100 LTV - mortgage you can still get a loan but your options will be much more limited than if you had a.

A personal loan may make sense if you can afford monthly payments for the entirety of the loan term and if it costs less than other types of credit. Use our borrowing calculator to work out how much you could borrow for a home loan to buy a house and what your home loan repayments might be. An establishment fee of up to 150 may apply for personal lending the fee may be different for non- personal lending.

Lenders must verify your income to make sure you can afford the loan payments. This mortgage calculator will show how much you can afford. Lets presume you and your spouse have a combined total annual salary of 102200.

To gain an understanding of how much you can afford to borrow you can use the personal loan calculator to estimate your borrowing power. Start by selecting what event or item you are borrowing for and go from there. 801010 loans consist of a first mortgage 80 and a second mortgage 10 that total 90 of the purchase price and a 10 down payment.

Loan approval in 4 hours. While student loans are a lifeline for many students who need them to afford college theres a limit to how much you can borrow. For example if you have high-interest credit card debt with multiple revolving balances you can use a personal loan to consolidate the debt ideally at a lower interest rate.

The comparison tables below display some of the variable rate home loan products on Canstars database with links to lenders websites for borrowers in NSW making principal and interest repayments on a. This loan is repaid either on the sale of the property or the end of the mortgage term whichever comes first. Calculate how much house you can afford with our home affordability calculator.

The calculator will ask you for your income a property value and deposit amount. This is because the average interest rate for both car loans and personal loans is different. The more accurate the details you enter into the calculator the more realistic your estimated borrowing capacity is likely to be so you may want.

Survey Here S What Americans Used Personal Loans For During The Pandemic Forbes Advisor

Top 5 Reasons People Take Out Personal Loans Personal Loans Unsecured Loans Person

Need A Personal Loan Here S How To Find Loans And Apply

Get Instant Loan Approval Via Bajaj Finserv App Personal Loans Personal Loans Online Loan

Personal Loan Calculator See Your Payments On A Loan Credible

How To Contact Bajaj Finance Personal Loan Contact Number Personal Loans Personal Finance Person

Welcome To Online Banking Personal Loans Online Online Banking Personal Loans

Personal Loan Calculator 2022 Calculate Your Monthly Payment Smartasset Com

Personal Loan Calculator Nerdwallet

17 Best Personal Loans For September 2022 Credible

The Pros And Cons Of Personal Loans Penfed Credit Union

Personal Loan Calculator

:max_bytes(150000):strip_icc()/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

Personal Loan Calculator Nerdwallet

Personal Loan Calculator Nerdwallet

How To Get A Personal Loan Rates And Fees Cnn Underscored

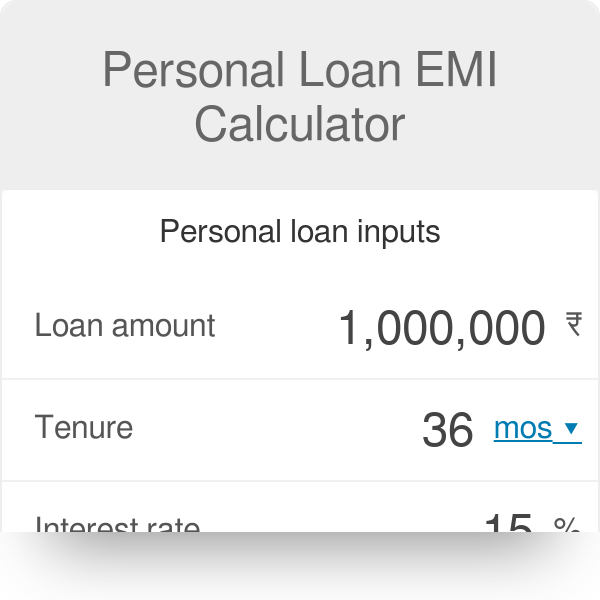

Personal Loan Emi Calculator